October 30, 2023October 26, 2023

Top Reasons to Hire a Realtor Experienced in Condo Sales and Purchases

September 15, 2023July 26, 2023

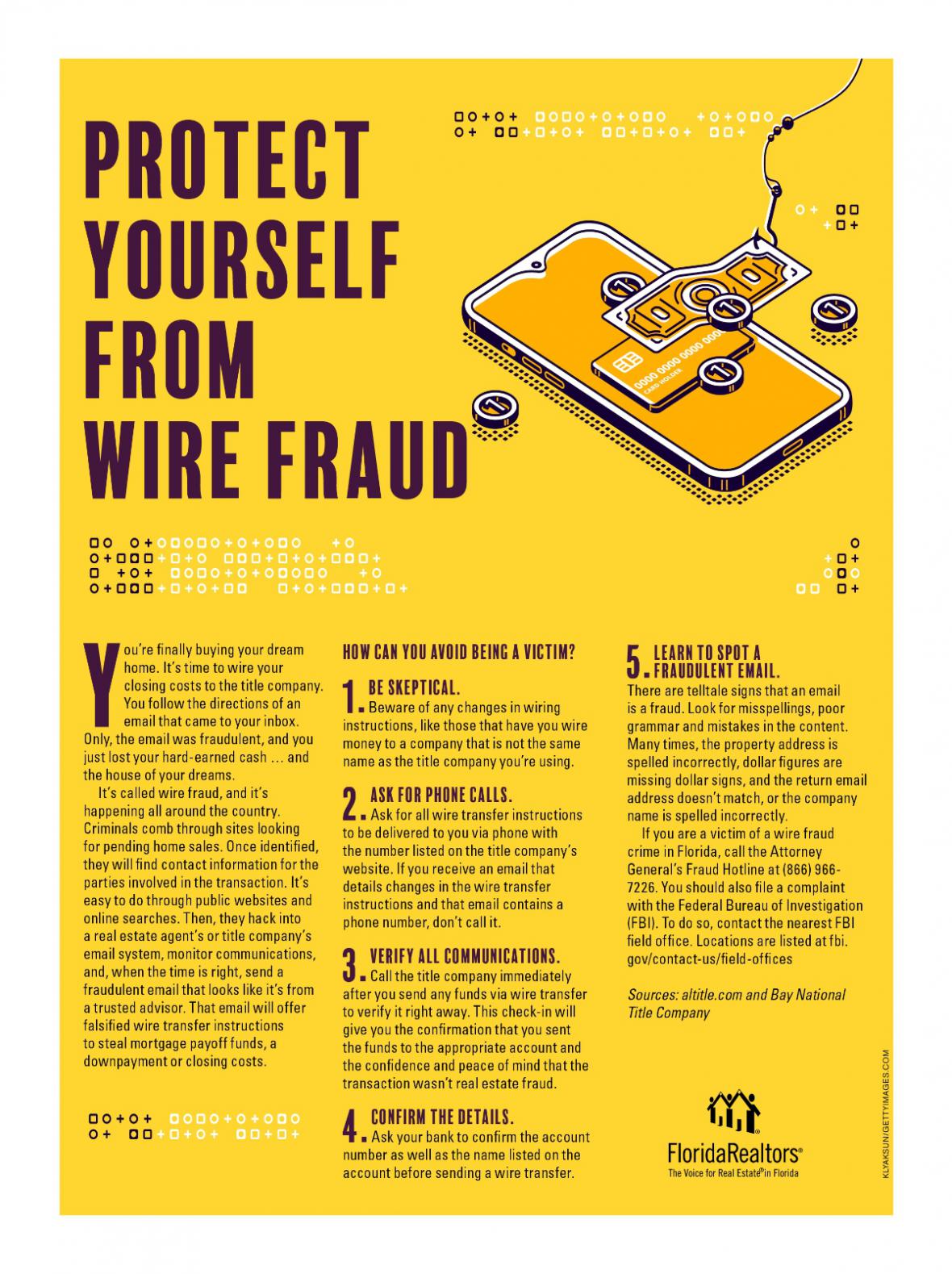

Protect Yourself From Wire Fraud

August 15, 2023August 1, 2023

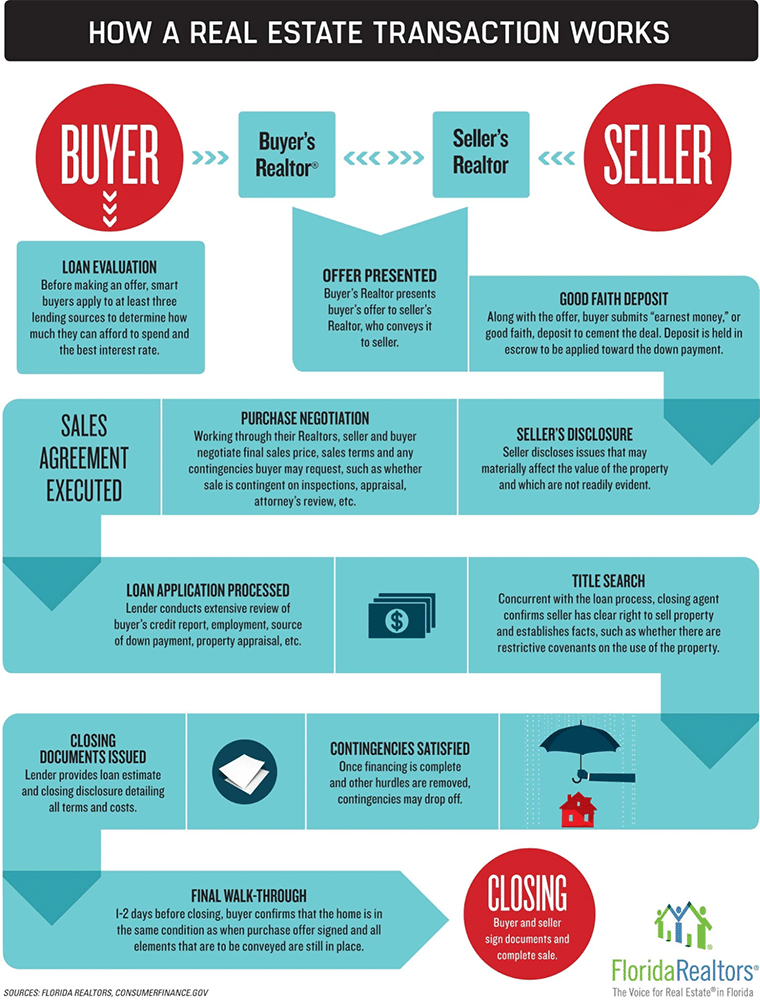

5 Steps Buyers Don’t Want to Miss – Even in a Hot Market

May 20, 2023May 5, 2023

7 Benefits of Using A Real Estate Agent

December 28, 2022May 5, 2023